You want to park your cash somewhere.

Savings accounts offer a mediocre 0.01% interest, the stock market is volatile, CDs/bonds returns are too ‘safe’, and being a landlord is too much headache.

RPS offers direct access to real estate investing in the heart of major cities across the USA. All without the hassle of managing and repairs as a landlord. Diversify your portfolio with an in demand and appreciating alternative investment.

The pains of Main Street asset returns

You don’t want to wait a decade just to get a mediocre ROI or settle on “what is available” from your retail banker. Neither do we.

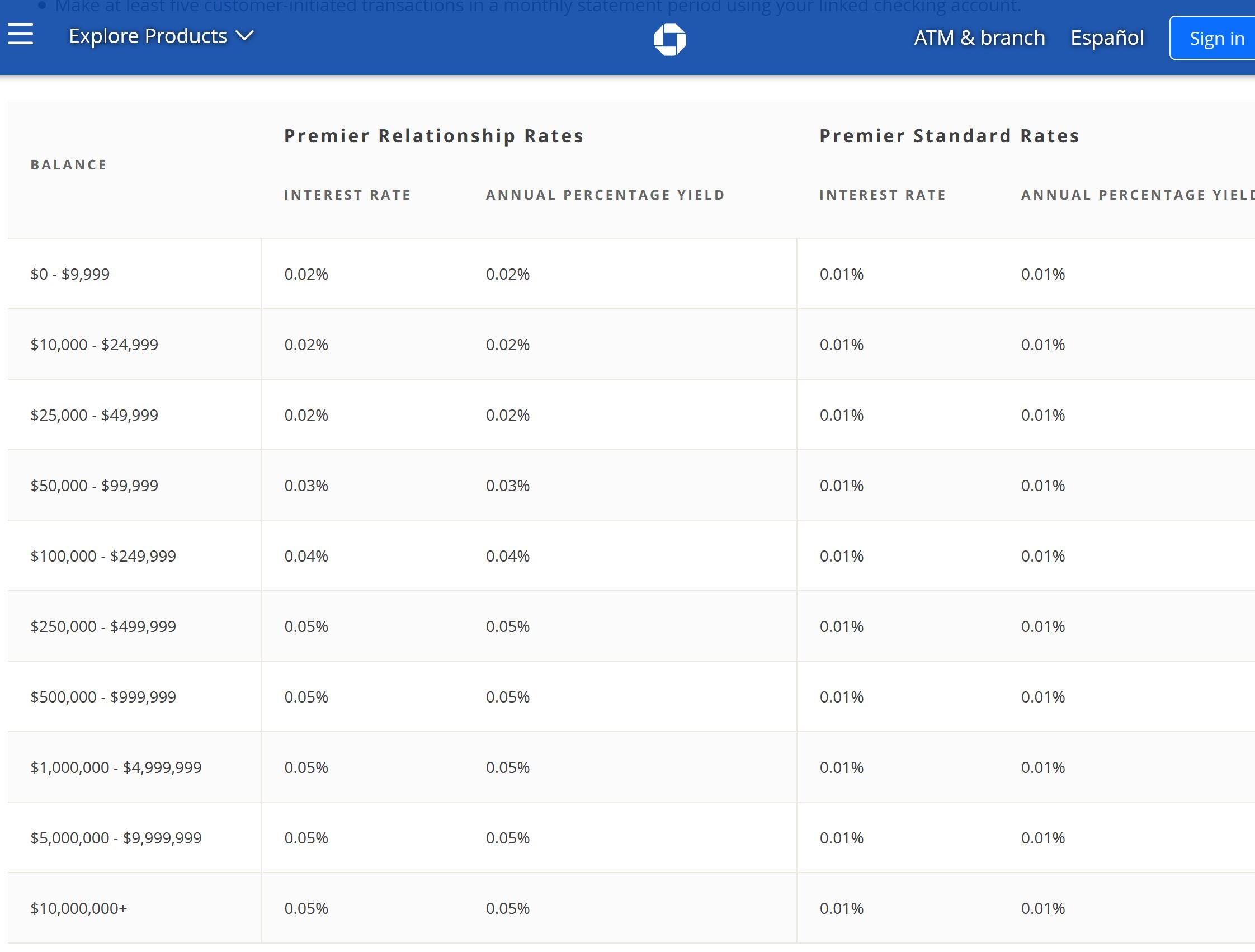

Enjoy 0.05% interest on a $500,000 checking account deposit when you bank as a premier client with Chase or Citibank

Expect a 0.05% return on a $250,000, 10 Year CD

Your 401K is locked-up until you are 59 1/2 — why wait that long?

Crowdsourced e-REITs like Fundrise or CrowdStreet require large capital to get an acceptable return, is open to all investors and highly illiquid. Wait an average of 4 years to see ROI.

Bank of America, "Platinum Honors" - 0.05% (Minimum: $100,000 deposit)

Chase, "Private Client": 0.01 - 0.05% (Minimum: $250,000 deposit)

Deposit $10mil to get 0.05% interest

Citi, "Citigold" - 0.04% (Minimum: $200,000 deposit)

Santander, $5mil deposit to get 0.05%

Ally Bank, 0.5%

Early retirement — it’s not impossible

We realized trading time for money (earned income) like a 9-5 job is the most inefficient form of income.

Problem with earned income:

We have finite hours in a day and can’t work 50 hours in one day to earn more

Income taxed at highest tax bracket (federal, state, social security, etc); 10% - 37%

Passive income from real estate solves the problem:

It’s like a money printer while you sleep, no action on your end

Taxed much lower as long term capital gains (10, 15 20%), not earned income